We have used Insights Network, a specialized blockchain for panel access and survey management on a blockchain, to gain some fresh insights on ‘crypto enthusiasts’.

Fieldwork took 12 days with low incentives of ~0.014$ per participant. Data collection was not fast because of the low incentive, yet we did achieve our objective to get at least 300 respondents to participate in our survey.

We asked 4 questions to 336 respondents spread across a selected set of countries.

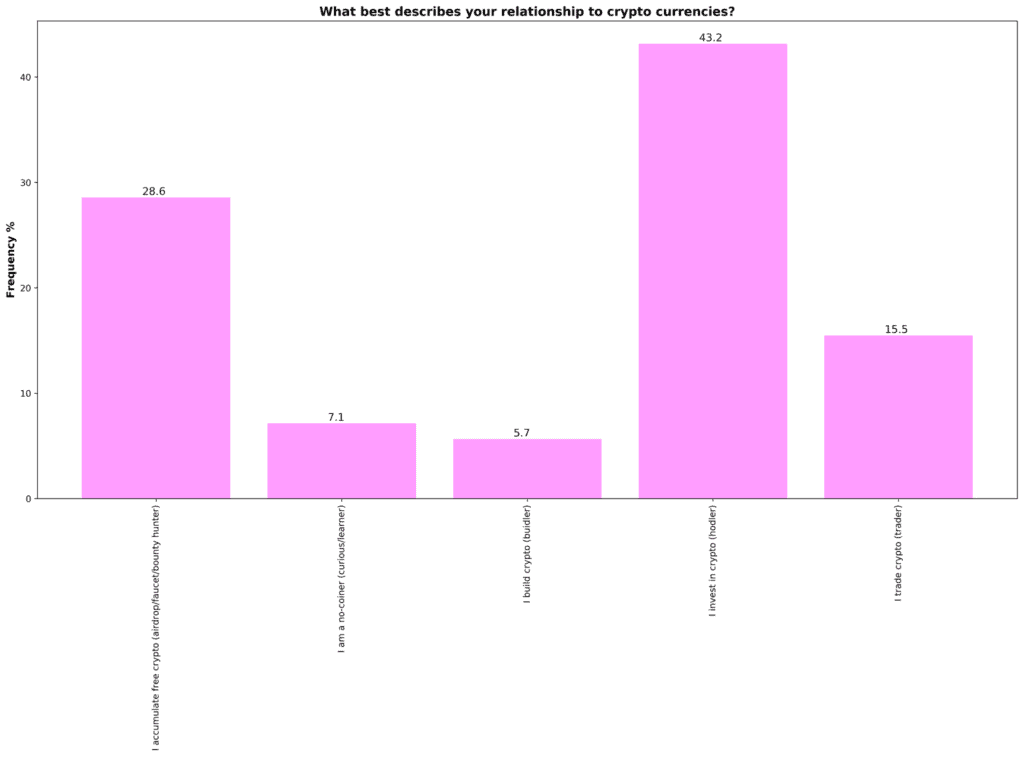

- What best describes your relationship to crypto currencies?

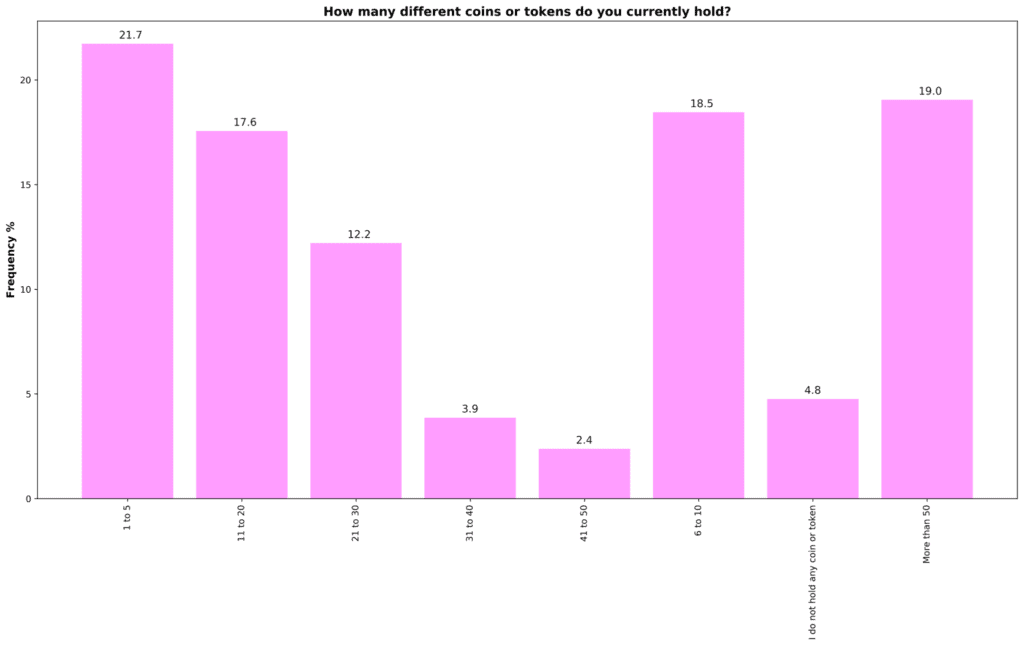

- How many different coins or tokens do you currently hold?

- Since you acquired your first coin or token, what has been the performance of your portfolio, in percentage?

- To your best knowledge, what coin best preserves user privacy ?

Descriptive sample information shows that crypto enthusiasts are expectedly mostly male, and that age distribution is not constrained to a maximum of 30 or even 40 years old, which one may have expected.

Russia is the most represented country in our sample (ca. 40%), followed by Turkey and Ukraine. Next come Western-European respondents with the Netherland and UK at ca. 10% each.

Most respondents are coin holders; only about 5% do not own any coin or token.

We find through or study that coin holders tend to be just ‘Hodlers’ (>40%), that is people casually keeping their holdings through market cycles without trading. About 30% earn crypto by participating in token distributions in various forms. 15% are active traders and only 6% are actively participating in crypto projects.

And what is the financial of coin-holders on their crypto portfolio?

50% are losing money with their crypto investment (and 20% have lost over 70% of their capital) while about 25% are lucky to enjoy a positive performance of their crypto portfolio.

Comparing the financial performance of different profiles of token-holders, people collecting free coins/tokens tend to fare better than others. The worst off are ‘hodlers’ despite the fact that it’s the group with highest percentage of very strong portfolio performance (ca 10% have more than tripled their capital, perhaps because they have been keeping their coins for a long time), followed by ‘traders’ and ‘buidlers’ who do only marginally better.

What coin or technology do they think most effectively preserves monetary privacy?

The majority of respondents think Bitcoin (used with Wallet Mixing, or just because it is the only crypto currency that people now) is best for privacy. Next best perceived option is Monero (20%), followed by Z cash (10%). Among the newcomers based on the ‘Mimblewimble’ protocol, Grin (6.5%) is significantly better established than Beam (0.3%).

This perception varies a little across countries. Respondents in Western Europe disproportionately value Monero for private transactions while other countries tend to value Bitcoin more. Dash is not perceived as a good privacy preserving option in Western Europe.

People in Russia, Netherlands and UK value Z Cash as well and Grin (though less so in the UK).

Alright, this is really random exploration, but any occasion to play with Python/Matplotlib is worth seizing !

We’re just a ping away if you would like to keep exploring with us.